Connected TV (CTV) streaming is at an all-time high! Streaming platforms like Netflix and Prime Video have become daily staples in many consumers’ lives. Many streaming services offer ad-supported tiers for a lower cost than ad-free tiers, meaning many consumers choose to watch video ads. This makes it no surprise that Connected TV advertising is becoming a key part of many brands’ digital advertising strategies. In fact, CTV ad spend is expected to reach $42.4 billion by 2027!

In this blog post, we’ll cover the CTV definitions and acronyms you’ll need to know so you can fully leverage CTV advertising as part of your omnichannel marketing strategy.

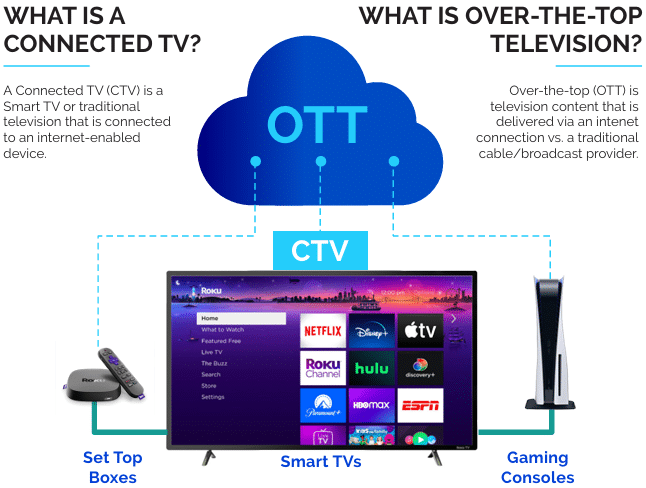

What is a Connected Television (CTV)?

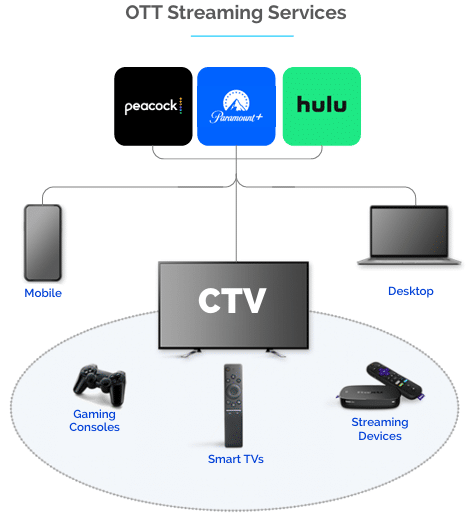

A Connected TV (CTV) is a Smart TV or any other type of device that can connect to the Internet and stream digital video. CTV also includes traditional televisions that are connected to internet-enabled devices, such as Amazon Firestick, Apple TV, Chromecast, or other devices.

Connected TV is a subset of Over-The-Top (OTT) TV.

Over-The-Top TV (OTT) refers to content that is delivered “over-the-top” instead of through a cable or satellite connection like traditional TV. This includes apps and services that are delivered via an internet connection and therefore don’t require traditional cable subscriptions.

Linear TV, widely known as traditional TV, includes cable and satellite where content is delivered in a scheduled format. Connected TV is different from traditional TV because viewers can stream video content on demand.

Types of Streaming Models

Before we cover the ins and outs of CTV advertising, it’s important to know the difference between the different types of streaming models that exist today.

Subscription Video on Demand (SVOD) is what most consumers consider “streaming services.” These services charge a monthly subscription fee to consumers. The most popular example of SVOD is Netflix.

Advertising-based Video on Demand (AVOD) are ad-supported services that are available to consumers, typically either for free or for a lower cost than an ad-free service. One example of AVOD is Hulu’s ad-supported tier, which is roughly half the cost of its ad-free tier.

Free Ad-supported Streaming TV (FAST), is free for consumers. However, it is different because this type of CTV content offers scheduled programming similar to traditional TV. Pluto TV is considered an example of FAST because it offers scheduled programming for free. In exchange for the free content, viewers are served ads as they watch.

Transactional Video on Demand (TVOD) includes content that consumers pay to watch. An example of TVOD is paying to rent a movie on Prime Video.

Understanding the CTV Advertising Landscape

For advertisers, there are many CTV terms and acronyms to be aware of before you create campaigns. The below terms describe different ways to go about ad buys.

Direct buys involve manual negotiations between people. The process involves finding a publisher, negotiating a price, and acquiring inventory. Alternatively, programmatic buys use automated software that handles the buying and selling process.

Demand-side platforms (DSPs) use automation to help advertisers buy ads. Advertisers use a DSP to upload creative, set a budget, and target an audience. The DSP then searches its network of publishers for available inventory that matches the advertiser’s criteria. Common examples of DSPs are The Trade Desk and Google DV360.

Supply-side platforms (SSPs) are software that helps publishers sell ad space for CTV and other inventory. SSPs connect publishers with ad exchanges, DSPs, and data management platforms. Publishers can then use SSPs to manage their inventory, set floor prices, and optimize deals. One example of an SSP is PubMatic.

Within different platforms, it’s also important to be aware of walled gardens. Walled gardens are platform-specific environments where the technology provider has control over the content, services, and operations. Walled gardens can make it challenging for advertisers to achieve precise targeting to reach the same consumers across channels.

For advertisers who want greater control of their CTV targeting, Deep Sync can help. With our third-party data, you can build an audience once and activate it across channels. So, it becomes possible to reach the same, exact audience on CTV, social media, and more.

We have partnerships with major DSPs, including Google DV360 and The Trade Desk, and our LiveRamp partnership enables us to activate audiences in CTV platforms such as MNTN and Cadent. Deep Sync’s B2B data is available directly in the Cadent marketplace, making it easy for advertisers to reach B2B audiences.

Additionally, the Deep Sync identity spine powers audience onboarding to MNTN. This process improves first-party data targeting by helping advertisers reach more of their current customers. Existing MNTN clients can now access Deep Sync data across MNTN solutions, including its new AI-driven MNTN Matched tool.

Want more CTV resources?

- “CTV Targeting: How Deterministic Data Powers Campaigns“: This blog post provides recommendations to help advertisers reach the right audience with their CTV advertising in 2025.

- “The Ultimate CTV Guide“: Expand your reach with always-on, individual- and household-based targeting with Connected TV advertising. Download this guide to learn how to fully leverage CTV advertising as part of your omnichannel marketing strategy.

0 Comments