Consumer packaged goods (CPG) is an incredibly competitive industry. According to McKinsey’s guide to CPG industry trends, consumers are looking for companies that are “special, different, and authentic,” causing businesses to push the envelope—both in terms of product development and positioning.

As consumer media habits shift, e-commerce grows, and new start-up CPG direct-to-consumer brands emerge, brands have to adapt to remain competitive. Companies must fortify their CPG advertising efforts through data-driven marketing to expand their reach and stay top of mind for consumers.

Explore our guide to CPG advertising to fuel your promotional efforts, covering the following topics:

- What is CPG advertising?

- Why is CPG advertising important?

- What are the current CPG advertising industry trends?

- How much do CPG companies spend on marketing?

- What percent of sales should you spend on CPG marketing?

- Top CPG Advertising Strategies

What is CPG advertising?

CPG advertising, or consumer packaged goods advertising, refers to the practice of promoting everyday items and products to consumers. Most grocery products, such as food, beverages, alcohol, cleaning supplies, and off-the-shelf health and beauty supplies, are classified as CPG. Because this industry is so saturated, businesses spend a massive amount of money advertising these products every year.

Why is CPG advertising important?

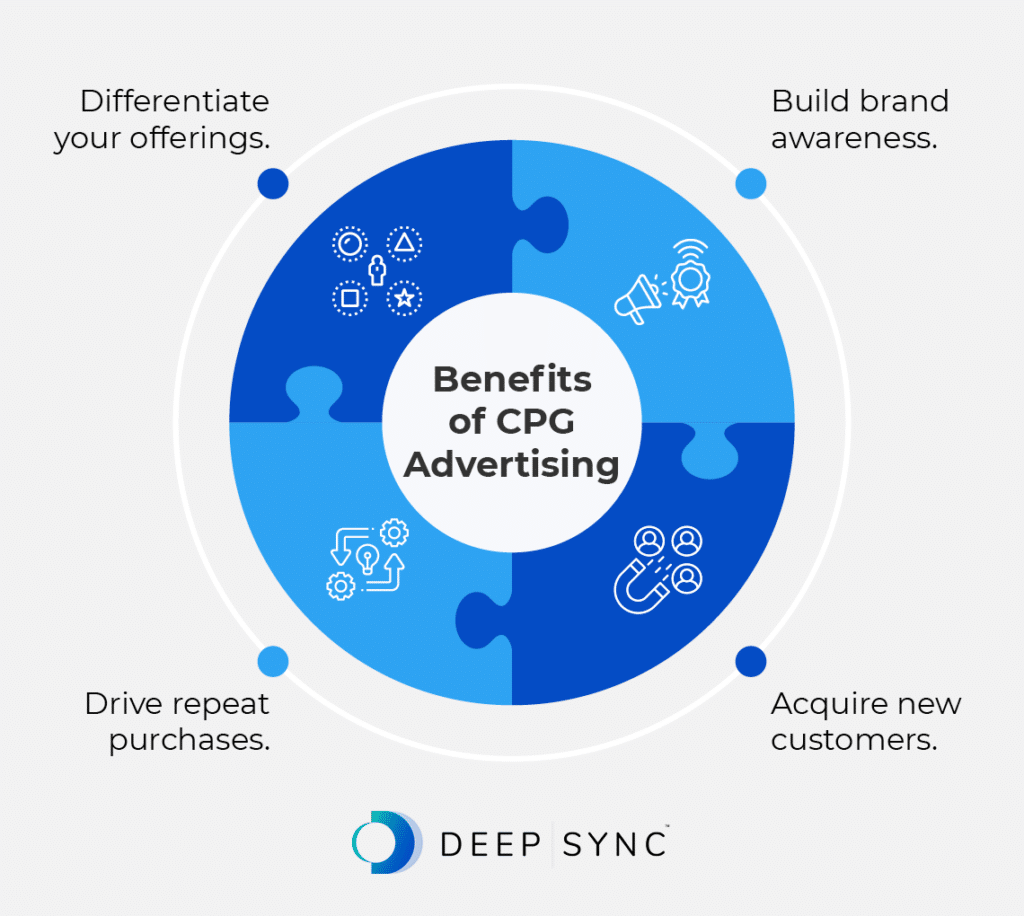

CPG advertising is important because it allows your business to:

- Differentiate your offerings. In a very competitive category where the success of one product comes at the expense of a competitor, it’s crucial to pinpoint what makes your product unique and communicate that value proposition to consumers. CPG advertising gives your business the opportunity to highlight why your product stands out—whether it’s your eco-friendly packaging, health benefits, affordable price point, or something else entirely.

- Build brand awareness. Traditionally, consumers have purchased CPG goods at third-party stores or online retailers, meaning marketers had to either influence the consumer before they entered the store via CPG marketing, develop product loyalty, or advertise to them within the store at the point of sale. With CPG advertising, you can familiarize consumers with your brand and push them to purchase directly from your ad.

- Acquire new customers. You can incentivize prospective customers to make their first purchase by offering promotions or discounts within your CPG ads. You may also use CPG advertising to target a new demographic for your business. For example, if your product is now available in Target stores across the Midwest, you may run social media ads for users in this region to educate them about your product and encourage them to make a purchase.

- Drive repeat purchases. When a product is already well established in the market, revenue increases are primarily driven by purchase volume and frequency growth. CPG advertising helps keep your product offerings at the top of consumers’ minds and encourages them to remain loyal to your brand.

By engaging prospective and existing customers, CPG advertising can maximize your reach and increase your bottom line.

What are the current CPG advertising industry trends?

Technology is driving significant changes across all industries, and the CPG industry is no exception. The convergence of offline and online is a major theme in the industry, with consumers shifting to online commerce and digital coupons.

Additionally, the continued growth of large omnichannel retailers, the thriving retail advertising industry, and the ease with which new consumer brands can build businesses are all influential factors. Specifically, here are some trends to be aware of:

Amazon

Online retail significantly impacts the business of traditional offline retailers. Amazon’s acquisition of Whole Foods increased the threat to traditional grocers and CPG marketers. More market power for Amazon’s proprietary CPG products creates risks for those marketing CPG products of all types.

Given Amazon’s access to customer data through online and loyalty programs, it is in a stronger position than traditionally data-poor CPG marketers.

Grocery Disruption

Partially in response, companies like Swiftly Systems and others are disrupting the grocery business and, in the case of Swiftly, are providing data driven media solutions (to help CPG marketers drive increased sales and return on ad spend) and tools (to help grocers compete with large online retailers like Amazon).

Retail Media

Conversely, e-commerce has given CPG advertisers new methods to influence consumers at the point of purchase. The ability to deliver ads to consumers in digital storefronts—as they make buying decisions—enables CPG advertisers to focus their efforts further down the consumer purchase funnel than much of their advertising has permitted in the past.

Direct-to-Consumer (DTC)

The DTC trend has not missed the CPG industry. Upstart companies like nuun and Magic Spoon are creating additional competition for traditional CPG marketers.

The ease with which new companies can build commerce solutions and execute direct-to-consumer customer acquisition has brought greater competition and innovation to the industry. To avoid missing out on significant opportunities, major CPG marketers are similarly building their own CPG DTC brands.

How much do CPG companies spend on marketing?

CPG is a very competitive industry. The CPG advertising business is where that competition happens; winners and losers are decided in grocery stores and online storefronts. To capture and retain consumer loyalty, CPG advertisers spend significantly more money on marketing than any other industry.

In 2025, companies are expected to spend $52.99 billion on digital CPG ads. According to Deloitte’s 2025 Consumer Products Industry Outlook, “A ramp-up in investment is likely to continue, as nearly 7 in 10 surveyed executives (69%) work at companies planning to increase their 2025 marketing and advertising expenditures as a percentage of revenue, while 76% plan to offer more sales discounts and promotions than they did in 2024.”

In a high-purchase-frequency industry like this, advertising CPG products is largely a non-stop activity.

What percent of sales should you spend on CPG marketing?

CPG marketing spend is currently around 17.8% of sales and 18.1% of total budget. Since consumers can quickly switch to a competitive brand, retaining their loyalty requires non-stop attention and thoughtful CPG ads.

Top CPG Advertising Strategies

Strengthen your CPG advertising approach with the following strategies:

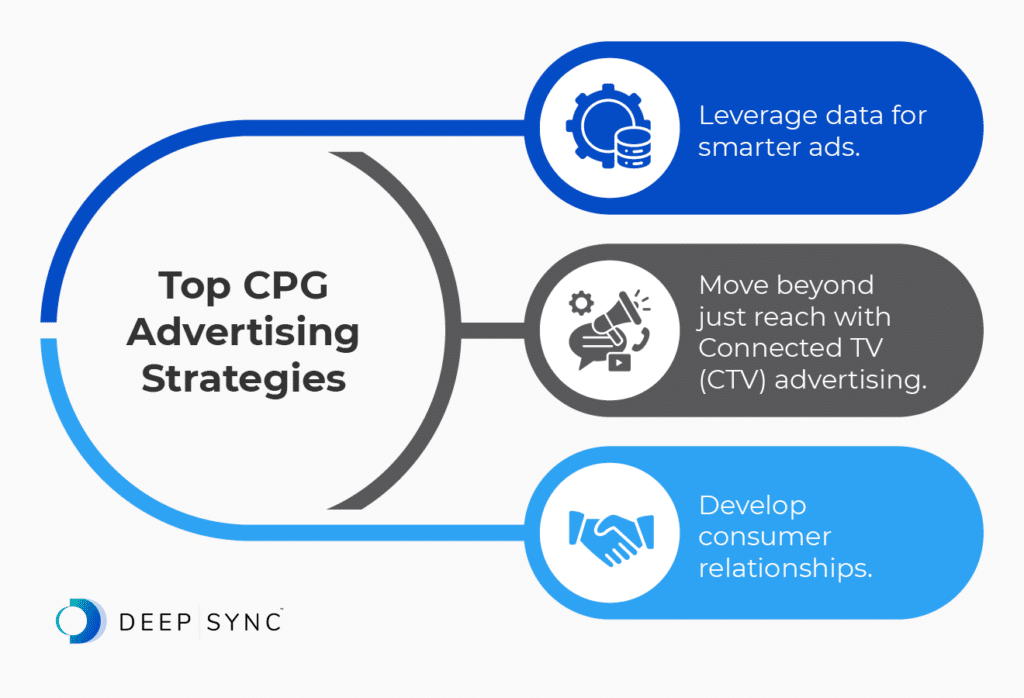

Leverage data for smarter ads.

CPG advertisers have historically not had sufficient data to optimize their CPG marketing spend. As they have sold their products mainly via retailers or other third parties, they have not been able to capture data about who is buying their products or how frequently.

Since CPG brands generally lack first-party data, working with leading companies like Deep Sync remains a critical piece of the puzzle. Understanding consumers’ CPG buying habits and advertising based on that behavior is crucial to making effective and efficient marketing decisions.

Move beyond just reach with Connected TV (CTV) advertising.

Traditionally, CPG TV advertising has been about reaching as many people as possible. In recent years, more consumers have embraced streaming television, and the scale of audiences has grown.

This expansion has allowed CPG advertisers to pursue more nuanced customer acquisition strategies through advanced CTV targeting capabilities. The ability to test and adjust creatives by audience persona or CPG buying cohort enables advertisers to achieve more with less.

Develop consumer relationships.

CPG brands’ marketing potential can be limited without access to direct first-party data from consumers. Pursuing DTC strategies yields many benefits, including better data, better margins, potentially higher consumer loyalty, and a more direct means of gaining customer insights.

Key Takeaways About CPG Brand Advertising

To say that this is a massive industry undergoing significant changes is putting it mildly! However, all of the changes in the CPG advertising industry create opportunities for existing brands to continue evolving their businesses and for new start-up DTC companies to gain a foothold in the industry.

As always, established CPG brands and DTC start-ups can both benefit from augmenting their customer acquisition and loyalty strategies via social and programmatic advertising with premium CPG datasets through Deep Sync One!

To help you kickstart your CPG advertising strategy, Deep Sync offers:

- High-quality consumer data to expand reach and find new prospects.

- Data hygiene and suppression services to make sure data is accurate and actionable.

- Data enhancement to enrich existing customer records with additional attributes.

- Audience profiling and insights to inform advertising decisions.

- Enhanced data onboarding to match and onboard customer data across digital platforms.

- Audience building and targeting via Deep Sync One to build and activate custom segments across social and programmatic channels.

If you’d like to learn more about the strategies discussed in this article before getting started, check out these additional resources:

- What Is First-Party Data? A Definition and How to Leverage It. Learn how first-party data can propel your CPG advertising efforts and how to collect it.

- CTV Targeting: How Deterministic Data Powers Campaigns. Dive deeper into CTV advertising and how you can use it to promote your CPG business.

- Lookalike Modeling: How to Get Started. Explore how your company can find high-value prospects who mirror your best buyers—using privacy-compliant, portable lookalike audiences built from your own customer data.

0 Comments